One year into the PhilaImpact Fund, a look at impacts

July 26, 2019

Category: Featured, Long, Purpose

July 26, 2019

Category: Featured, Long, Purpose

Disclosures

This is a guest post by Pedro A. Ramos, president and CEO of the Philadelphia Foundation and Don Hinkle-Brown, president and CEO of Reinvestment Fund.When we announced the PhilaImpact Fund a year ago, we noted that it was created to fill a gap, offering a safe, smart, direct investment opportunity tailored specifically to the Greater Philadelphia region.

The unique hybrid model provides two paths to support community development in the region: a direct investment offered by Reinvestment Fund and a tax-deductible donor advised fund through the Philadelphia Foundation. It is deliberately structured as a partnership between two strong anchor institutions with a flexible product to match risk appetites. It offers appropriate investment levels, a regional connection that investors can feel, targeted asset classes, and meaningful metrics.

Our goal was to ensure that the opportunity gaps that exist in our communities get smaller so that every resident has a chance to thrive from possibilities born from the region’s vibrancy. The results to date have been inspiring.

Just as significantly, we sought to bring new dollars to the impact investing space to seed further participation. Our achievements thus far make it clear that donors and investors in our region are committed to increasing the vitality of our region through community investment.

The PhilaImpact Fund — one year in

To date, the PhilaImpact Fund has raised $11 million from a diverse array of investors as well as initial investments from the Philadelphia Foundation and Reinvestment Fund. The PhilaImpact Fund remains open to new promissory note and DAF investors as it continues to build on this momentum.

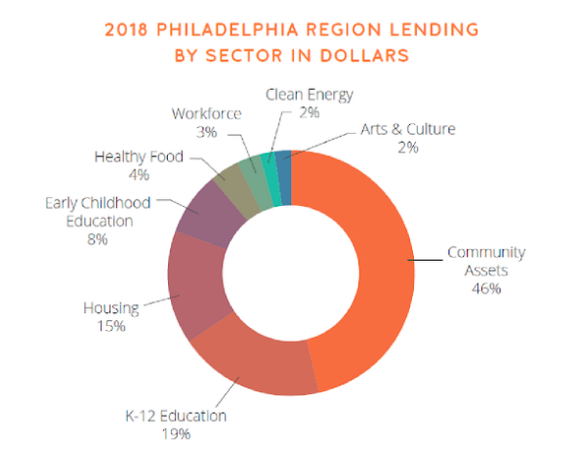

Supported by the PhilaImpact Fund and other capital sources, Reinvestment Fund provided $48.4 million in financing to projects in the Philadelphia region in 2018 that will continue to generate positive impact in the years to come.

The results include:

- Nearly 1,000 full-time equivalent construction jobs created,

- More than 700 full-time equivalent jobs created or retained,

- 140 homes created, rehabilitated, acquired, or preserved,

- 680 early childhood education seats created or retained,

- 2,700 K-12 seats created or retained, and

- 664,900 square feet of commercial space and community facilities created, rehabilitated, acquired or preserved.

Local funding, local impact

Created to serve neighborhoods and communities throughout Philadelphia, Chester, Montgomery, Bucks, Delaware, Camden and Burlington counties, the PhilaImpact Fund’s footprint is broad.

The cumulative impact of the capital deployed in the region is being felt in places like East Kensington, where the long-vacant Franklin Carpet Mill is being revitalized and reimagined. On the border of the epicenter of the opioid epidemic in Philadelphia — and nationwide — nearly half of East Kensington residents live below the poverty line. It’s a neighborhood in dire need of community connections and services. Reinvestment Fund identified this need and deployed capital to transform the building into Huntington Mills, a mixed-use residential and community center for health and wellness.

The building will include nearly 40 apartment units for social workers and therapists in the health and human services industry. These tenants will receive a considerable discount on rent. The building will also offer 24,000 square feet of space for health and wellness nonprofits, including high-quality childcare providing early intervention and mental health services to children. As a result, the nonprofits will have the space to do the work they specialize in, and employees will have access to housing that allows them to create a personal and professional connection in the community.

In Frankford, Reinvestment Fund provided financing that expanded Grace Neighborhood Academy with 13 additional classrooms, a playground, an indoor gym, a new kitchen, and improved security. The new center can serve 260 more children from low-income families, enrolling up to 542 children under five. A partnership with Harcum College will train and build the pool of qualified early education teachers while increasing educational attainment in the community.

In Point Breeze, Reinvestment Fund financing is helping a mission-driven developer build energy-efficient homes on reclaimed vacant lots. The houses will be sold at affordable prices to buyers with moderate incomes. This will bring a mix of housing options to the dense South Philadelphia neighborhood that is considered by many to be one of the city’s fastest gentrifying neighborhoods. These case studies illustrate the power and potential of impact investments.

The revolutionary nature of long-term impact

Impact investing is changing the model for community support and encouraging a long-term vision for success, something both the Philadelphia Foundation and Reinvestment Fund endorse.

Fully a century ago, Philadelphia Foundation was among the first community foundations — what was then a new way for big and small donors to come together and grow the value and impact of their charitable investment to benefit local people and places they knew and cared about. At the time, bank trust officers were seeking a way to effectively honor donor intent in perpetuity, and community foundations became the apparatus that allowed them to do so.

As the Philadelphia Foundation marks its 100th birthday, it’s proud also to celebrate the first year of a new approach offered through the PhilaImpact Fund and the partnership with Reinvestment Fund to create tangible community outcomes while preserving and growing capital that — once the investment matures – could again be employed for community impact.

We’ve come to recognize that the potential in our shared expertise centers on connecting more donors and investors to improving the region where they live.

In our experience, identifying these opportunities plays out on three fronts:

- Community Input — A detailed and nuanced understanding of a community’s needs is at the heart of a more impactful project. The Philadelphia Foundation and Reinvestment Fund are in constant coordination with nonprofits, group leaders, and populations of communities who will benefit from our initiatives. Participants in the Philadelphia Foundation’s YOUTHadelphia program, in which teens allocate grant dollars to serve their peers, are taught and employ research best practices to hone in on topic areas that become their funding priorities. More than 5,000 residents from across the region gathered for civic conversations in On the Table Philly, an initiative supported by the Knight Foundation. Afterward, the Philadelphia Foundation supported $43,000 in $1,000 Activate mini-grants to implement ideas generated by the conversations, effectively crowd-sourcing the issues on the minds of residents, without the intervening filters that too often apply. Similarly, Reinvestment Fund ’s staff and boards are actively engaged in the communities that it serves. Reinvestment Fund is a nationally known community development financial institution, with a federally certified status confirming its mission and accountability to low-income communities.

- Focus on The Big Picture — Each successful impact investment project connects to a broad community agenda. A rehabbed building may address affordable housing, for instance, as well as neighborhood revitalization. This big-picture connection must be felt by donors and investors as well as the community being served to inspire additional participation.

- Sustained Optimism — Simply put, results can take time. Community investments require both patience and faith that meaningful change can occur, project by project.

We’ve seen what’s possible at the intersection of trusted foundations, community revitalization groups, and values-driven investors. Impact investing represents a powerful way to create something greater out of shared expertise. We owe it to communities, donors, investors, and everyone to facilitate better impact investing projects with the potential for sustained good in the Greater Philadelphia region.

Project

On the Table PhillyTrending News