The ‘quality jobs’ framework can be an effective tool for those seeking to invest in companies

October 5, 2021

Category: Featured, Long, Purpose

October 5, 2021

Category: Featured, Long, Purpose

Disclosures

This guest column was writted by Julia Enyart, a VP on the sustainable and impact investing team for the Center City-based Glenmede Trust Company.One hundred eighty-one CEOs walk into a room …

A year before mask mandates and the concept of social distancing emerged, a group of 181 CEOs gathered to pledge a commitment not just to shareholders, but also to stakeholders, including employees, customers and their local communities. CEOs representing Amazon, Marriott, Salesforce, Apple, General Motors and other U.S. industry-leading companies comprise the Business Roundtable, a group committed to a set of key tenets, including:

- Delivering value for customers

- Promoting fair treatment of employers and suppliers

- Supporting communities, and

- Generating long-term value for all stakeholders.

The COVID-19 pandemic has forced an earlier- than-expected stress test for public companies that aspire to these principles, also known as “stakeholder capitalism.” Companies are facing increasing scrutiny around their reactions to the pandemic, rising inequality among women and communities of color, and calls to combat climate change.

As sustainable and impact investors, we must ask ourselves, did the Business Roundtable companies follow through on these promises? And, at a more local level, how have small and medium-sized businesses in Philadelphia that subscribe to these same tenets fared in supporting all stakeholders, often with fewer resources?

As individuals, endowments, foundations and family offices survey their investment options, they should feel empowered to tilt their portfolios toward companies with “quality jobs,” or jobs in which employees, customers, and communities thrive and to use advocacy to push companies to disclose this data. By assessing which companies do and do not offer quality jobs, investors may discover a lens to mitigate risk and identify value-additive opportunities. To that end, emerging studies increasingly illustrate that companies generating quality jobs may outperform those that do not, building on years of research illustrating the potential value of incorporating environmental, social and governance (ESG) criteria into the investment process.

In many ways, the pandemic offers a sobering reality check on the durability of shareholder-centric business models. Using the quality jobs framework as a lens can be an effective tool for those seeking to invest in companies that design long-lasting jobs with the power to attract, retain and empower employees.

Defining quality jobs and the potential linkage to performance

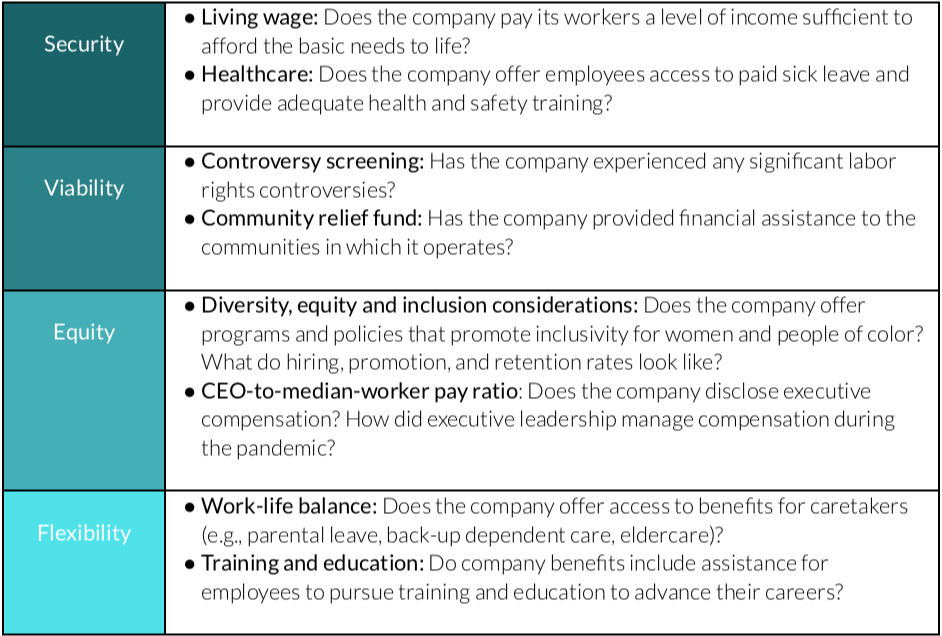

What exactly constitutes a quality job? Over the last year, Glenmede partnered with New York University’s Center for Sustainable Business, which sought to define the components of a quality job and explore if a link exists between companies offering quality jobs and performance. Through its SVEF framework, NYU defines the four aspects of a quality job as:

- Security, or the dependability of a continued job

- Viability, which describes a company’s reputation and the relationship to communities in which it operates

- Equity, or the fairness and diversity among workers and governing bodies of the firm

- Flexibility, which describes employees’ freedom of choice, access to options, and potential career mobility

Judging a company’s ability to offer a quality job across the SVEF framework is not always straightforward. Suppose an investor were to apply this to Amazon, for example. They might judge that Amazon fares well under Security in terms of competitive wages but poorly under Viability when it comes to company reputation amid accusations of willingness to promote productivity at all costs, or Equity when it comes to CEO-to-median-worker pay ratio.

This level of analysis may offer performance benefits. NYU’s research found that higher SVEF scores of larger companies were associated with higher profitability, product quality and levels of customer satisfaction alongside lower company risk, including total volatility and tail risk. Similarly, small and medium-sized businesses also demonstrated higher job growth rates, higher engagement and lower turnover, suggesting that companies of all sizes benefit from creating quality jobs.

Quality jobs in the Greater Philadelphia region

Philadelphia-area companies have emerged as leaders amid varying responses to the pandemic and treatment of stakeholders. Camden-based Campbell Soup Company implemented a series of measures to protect its employees and supply chain, including aggressive social distancing practices in factories, expanding front-line workers in response to increased demand, and recognizing the work of mission-critical staff with premium payments. In addition to supporting employees throughout its supply chain, Campbell illustrated its commitment to the local community through 67 COVID-19 Community Recovery Grants, totaling over $9 million to local food banks, pantries and community organizations.

Likewise, the Reinvestment Fund, a Philadelphia-based community development finance institution (CDFI), sought to support small and medium-sized businesses through financial literacy training. A Reinvestment Fund survey of 400 early child education (ECE) providers in fall 2020 revealed that 97% of respondents had lost income since the onset of the pandemic, with 23% assuming debt and 85% accessing grant funding to stay operational. Through a financial literacy program targeting ECE providers, the Reinvestment Fund’s trained staff on how to prepare financials to access critical funding.

The future of the S in ESG investing

At Glenmede, we’re having conversations with individuals, endowments, foundations, and family offices about how they might invest in companies that support employees, customers and the community. We work to identify clients’ investment and impact priorities, provide them with tools and resources to design customized portfolios, and set tangible goals and track progress against them. As data around corporate America’s response to the pandemic continues to evolve, we anticipate being able to increasingly track the potential link between stakeholder-centric companies and performance.

If we can gain any wisdom from the last year, it’s that resiliency, agility and flexibility are required for any modern company seeking to endure this challenging period and to rebuild stronger.

###

Interested in exploring this topic further? Join ImpactPHL on Nov. 9 for a discussion titled “The ‘S’ in ESG: How Corporate Responses to the Pandemic Shape ESG Investing” that will explore how companies are reshaping their policies to generate “quality jobs” in a post-COVID world.

Project

ImpactPHLTrending News