This is what individuals who invest in CDFIs want you to know

July 1, 2021

Category: Featured, Long, Purpose

July 1, 2021

Category: Featured, Long, Purpose

Disclosures

This guest column was written for ImpactPHL Perspectives by Pam Porter, a member of Social Venture Circle in Philadelphia, managing partner of Stepping Stone Partners, LLC, and executive director of the National Disability Finance Coalition. It is reprinted with permission.Last year at this time, as the COVID-19 pandemic gripped our country, Babbie Jacobs and I partnered through Social Venture Circle (SVC) to showcase Community Development Financial Institutions (CDFIs).

Certified by the U.S. Department of Treasury, nearly 1,300 CDFIs serve persistently impoverished communities and historically underserved populations with responsible financial services and technical assistance. The pandemic illustrated the financial services ecosystem’s failure to serve poor, disabled, and BIPOC people and communities; yet CDFIs filled the gap and succeeded in serving these overlooked and financially vulnerable populations.

Through SVC, we published the first-ever directory of 60 CDFIs that accept individual investments, and held a series of webinars, attended by hundreds, to showcase CDFI work, impact, and investment opportunities. Now the work expands with community catalysts such as ImpactPHL.

To motivate others to invest, we highlight three CDFI investors. One investor couple is laser-focused on their home community of Lancaster; another investor has spent her professional and volunteer energies at the intersection of philanthropy and impact, and the third is an international venture capitalist who returned to the US and found CDFI investments to be “no-brainers.”

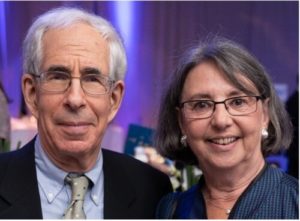

Carl and Ellen Pike – Investors with a local focus

Carl and Ellen Pike have lived in Lancaster for 50 years, moving there when Carl joined the faculty at Franklin and Marshall. 25 years ago, Carl sat on the Lancaster School Board with the future CEO of Community First Fund (CFF), Dan Betancourt. Carl’s work on the School Board and Ellen’s long career in high school education provided both Pikes with a close look at the community disparities across Lancaster, especially for people of color.

They believe deeply that “equitable opportunities make life better for everyone. All benefit when the entire community is healthy.”

When Dan was hired as President and CEO of CFF in 1999, Ellen and Carl became acquainted with the work and impact of their local CDFI. Ellen says: “We really love this community. We’ve been employed here, raised a family, and want to give back.” Early in her career, Ellen worked in finance and saw first-hand how the financial system failed to create opportunities for all.

In CFF, they discovered a community lender founded by a coalition of African-American, Latino, and white community leaders committed to increasing opportunities for economic prosperity for all. That mission and CFF’s values of equity and justice aligned with the Pike’s personal values. In addition to serving on the board of directors, the Pikes also became investors in the CFF private note program.

They have enjoyed following the local work of CFF as it has expanded geographically and in the type and size of projects financed. If they read about a restaurant CFF financed, they enjoy going to that restaurant; if a hotel is financed, they see it being built and the quality jobs created. They are excited about CFF’s latest venture to launch a credit union serving Lancaster County. “The credit union directly addresses the problems facing the unbanked and underbanked.” They so believe in the potential of the credit union they have helped capitalize it with a donation.

Babbie Jacobs – national leader in philanthropy and impact investing

Babbie Jacobs has advocated for impactful philanthropy throughout her career. She is committed to amplifying the intersection of philanthropy and building a more just society as reflected in her recent affiliations.

At the Alaska Community Foundation, she built strong relationships across the state with indigenous, social service, philanthropic and policy leaders. At Bolder Giving, she ran peer programs to enable philanthropists to “Give More. Risk More. Inspire More.” Now with Social Venture Circle, she heads the New York chapter and the community investing working group.

Babbie describes the impact of COVID-19 on small businesses as a turning point in her love affair with CDFIs. As an angel investor, Babbie thrives on relationships with impact entrepreneurs and regularly communicates with her investees. While she has known about CDFIs for decades, watching them mobilize to serve entrepreneurs during the pandemic demonstrated their unparalleled power to provide robust financial and technical assistance to business owners overlooked by the mainstream financial services industry.

Babbie also cares about the “silver tsunami” of business owners, approaching retirement, looking for solutions to pass on ownership of their enterprises. Worker-owned cooperatives provide a multi-stakeholder benefit to ensure job retention and opportunities for asset development. She has showcased CDFIs such as Seed Commons and Shared Capital Cooperative that structure and finance such transitions in a Social Venture Circle webinars.

Babbie’s passions and investments align, as she only invests in a broad portfolio of CDFIs nationally, including Coastal Enterprises, LiiF, and Craft3. These investments reflect a wide range of impact interests from indigenous people to BIPOC business owners to economic justice in her home borough of Brooklyn, New York. She recently set up an account at Brooklyn Federal Credit Union, a CDFI Credit Union, and enjoys knowing she supports their work whenever she passes a branch. She uses her voice with her investment advisor to expand the CDFI investments available to their clients, which they have done.

She wants other investors to know “I feel terrific about having my money invested in CDFIs who know their communities, work with their communities to make decisions that are best for the people that live there, and often many of the staff are members of the community.”

Dorothy Adams – venture capitalist returns to the US

Dorothy Adams graduated from Princeton and Wharton and then spent 13 years living and working in the Netherlands as, among other things, a venture capitalist. When she and her husband moved to the U.S. in the early 2000s, they put down roots in Connecticut. Dorothy soon put her M&A experience to use with New Haven Community Loan Fund that was merging with two other state-based CDFI loan funds. Fast forward five years and Dorothy is the board chair of the merged entity, Capital for Change!

Through this process, Dorothy describes the “aha” moment that began her CDFI impact investing journey. She recalls looking at Capital for Change private note — “it earns a better interest rate than a bank CD or savings account, the principal is returned, and the community impact is huge.” Her conclusion: “This is a no-brainer.”

In her role as board chair of Capital for Change, she interacts with other CDFIs at convenings such as Opportunity Finance Network’s annual conference. For her, it is inspiring to recognize that Capital for Change is part of a national movement that numbers nearly 1,300 certified CDFIs across 50 states with over $150 billion of assets deployed to underserved communities and people.

Since her initial investments in Capital for Change and a CDFI intermediary, she has started looking at other CDFIs examining investment themes such as environmental impact. She has found that whatever topic aligns with your interest in social and economic justice, there is a CDFI having an impact in that area.

Dorothy cites the paper published by Social Venture Circle identifying opportunities for individuals to invest in CDFIs as an invaluable resource for impact investors. For as little as $1,000, individuals can put their funds to work for impact.

Dorothy hopes we can start a viral movement to energize individuals to invest in CDFIs. She asks: “What should the hashtag be?”

Wrap Up:

The bottom line is this: If you are an investor, you can be an impact investor. CDFIs are the ultimate double bottom line investment — earn a return on your principal and see the impact amplified many times over. The CDFI Fund, the certifying body of CDFIs, notes that a dollar invested in a CDFI generates between 8-14x impact.

Now that’s a good return on investment!

Project

ImpactPHLTrending News